Mastering the Hammer Candlestick

A Beginner's Guide to Understanding and Trading this Powerful Chart Pattern

If you are new to the world of trading, the Hammer candlestick is a powerful tool you should be aware of. In this comprehensive guide, we will walk you through the meaning, types, and how to effectively trade with the Hammer candlestick pattern. Whether you're a seasoned trader or a beginner with little experience in the financial markets, this article is designed to make the concept of Hammer candlesticks easy to understand and apply.

Introduction

In the realm of technical analysis, candlestick patterns are visual representations of market movements, helping traders predict potential trend reversals and price movements. The Hammer candlestick, a popular and straightforward pattern, is formed when the market exhibits specific price action characteristics.

Meaning of the Hammer Candlestick

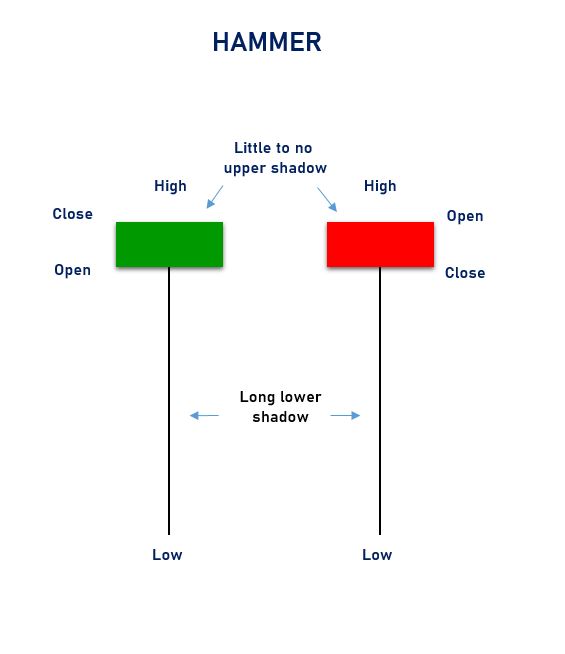

The Hammer candlestick is a bullish reversal pattern that signifies a potential end to a downtrend. It is characterized by a small body and a long lower shadow (or tail) that is at least twice the length of the body. Visually, it resembles a hammer, hence the name.

When a Hammer candlestick appears after a downtrend, it indicates that sellers have lost control, and buyers are stepping in. This shift in sentiment often leads to a potential upward movement in the market.

Types of Hammer Candlesticks

There are several variations of the Hammer candlestick pattern, each with its own unique characteristics. Some common types include:

1. Classic Hammer: The Classic Hammer has a small body and a long lower shadow. It is one of the most recognisable and reliable bullish reversal patterns.

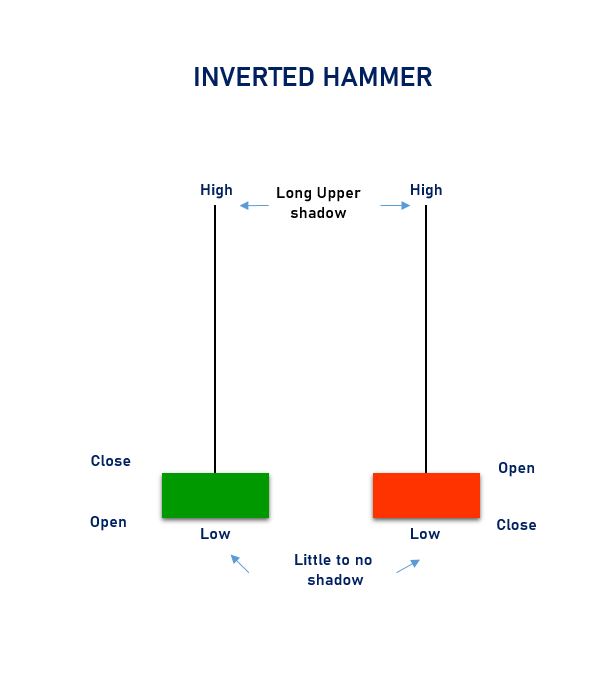

2. Inverted Hammer: The Inverted Hammer is similar to the Classic Hammer, but it appears after an uptrend. It signals a potential trend reversal to the downside.

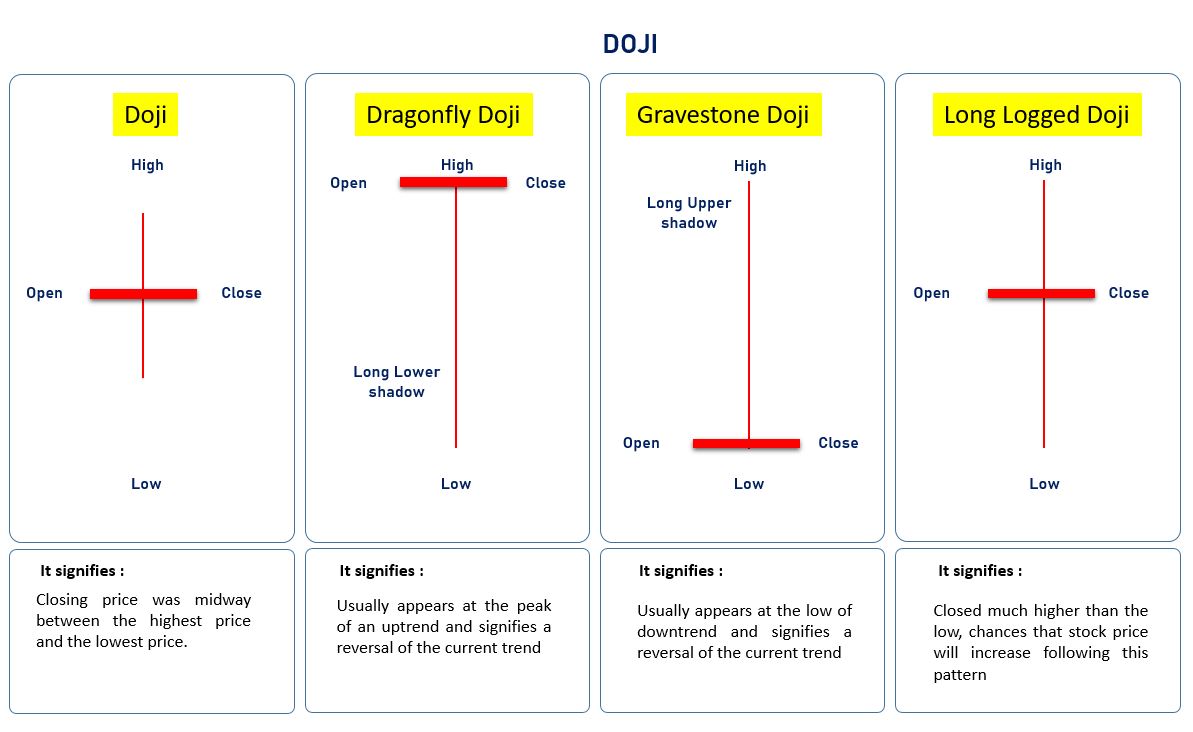

3. Dragonfly Doji: The Dragonfly Doji is a special type of Hammer with no body and a long lower shadow. It suggests a potential reversal from a downtrend to an uptrend.

4. Gravestone Doji: The Gravestone Doji is the opposite of the Dragonfly Doji. It has no body and a long upper shadow, signalling a reversal from an uptrend to a downtrend.

How to Trade with the Hammer Candlestick

Trading with the Hammer candlestick pattern involves a few simple steps:

Step 1: Identify the Hammer

First, you need to identify the Hammer candlestick on the chart. Look for a candlestick with a small body and a long lower shadow, resembling a hammer.

Step 2: Confirm the Pattern

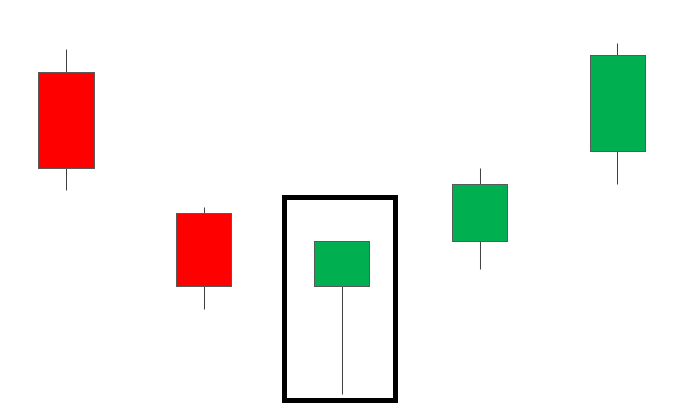

To increase the reliability of the pattern, look for confirmation. This can be in the form of a bullish candlestick that forms after the Hammer. It validates the potential reversal signal.

Step 3: Set Stop-Loss and Take-Profit Levels

To manage your risk effectively, set a stop-loss level just below the low of the Hammer candlestick. This will protect your position in case the market moves against you. Additionally, set a take-profit level to secure your profits if the market moves in your favor.

Step 4: Implement Risk Management

As a trader, it's crucial to understand the importance of risk management. Only risk a small portion of your trading capital on each trade, so you can protect yourself from significant losses.

Step 5: Monitor the Trade

Keep a close eye on your trade and monitor price movements. If the market behaves as expected, you can exit the trade at your predetermined take-profit level.

Conclusion

The Hammer candlestick pattern is a valuable tool in a trader's platform. Its simplicity and reliability make it ideal for traders of all experience levels. By understanding the meaning, types, and how to trade the Hammer candlestick, you can enhance your trading skills and make more informed decisions in the market. Remember to always practice risk management and continuously learn and improve your trading strategies for a successful trading journey. Happy trading!